is there real estate transfer tax in florida

According to Section 201021a Florida Statutes Deeds and other documents that transfer an interest in Florida real property are subject to documentary stamp tax. Property Tax Exemptions and Additional Benefits.

I Signed Over My House To My Daughter How Do I Reverse That The Washington Post

In Florida real estate transfer taxes also known as a stamp tax or doc stamp are imposed on the transfer of any residential and commercial property and any written obligation to repay the money whether secured or unsecured.

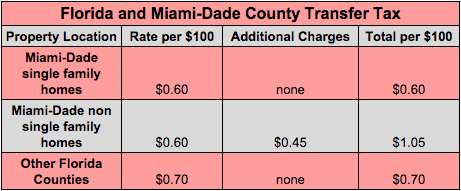

. If passed this new transfer tax would be 20 for amounts over 2. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every county except Miami Dade where it is 060 per 100.

The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate. These can include fixed-amount non-ad valorem assessments. Do I have to pay transfer tax on a refinance in Florida.

Miami-Dades tax rate is 60 cents. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. For the purposes of determining whether transfer taxes are owed will depend on the amount of money or other consideration that is paid or to be paid for the transfer of the real estate.

In Florida transfer tax is called a documentary stamp tax. The Florida documentary stamp tax is a real estate transfer tax. Florida is no exception.

Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. Documents that transfer an interest in Florida real property such as deeds. For example if.

The average property tax rate in Florida is 083. Sales and Use Tax. Each county sets its own tax rate.

In Miami-Dade County the tax rate is 06. There are not any additional transfer taxes for cash out just use the new loan amount. 0917 sections 196011 and 19626 FS.

Its customary for the seller of the property to pay for this tax in Florida. See Rule 12B-4014 Florida Administrative Code for additional documents exempt from tax. There is a doc stamp of 3.

Real Property Dedicated in Perpetuity for Conservation Exemption Application R. There is also an annual property tax on any. Most people around the world pay taxes on the transfer of real property.

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. Thankfully calculating the addition of this closing cost to any given real estate deal is easy. In every county except Miami-Dade the Florida transfer tax is 07 of the purchase price of the home.

The seller is responsible for paying any real estate transfer taxes which are charged when the title for the home is transferred from the old owner to the new owner. Property taxes apply to both homes and businesses. Massachusetts MA Transfer Tax.

The amount of. There is currently no Boston transfer tax however the City of Boston proposed a new transfer tax in January 2022. People who transfer real estate by deed must pay a transfer fee.

Since there is no other consideration for the transfer. The documentary stamp tax on a 300000 home would equal 300000. There are also special tax districts such as schools and water management districts that have a separate property tax rate.

In Florida this fee is called the Florida documentary stamp tax The documentary stamp tax is broad and could apply to any transfer of an interest in property. The Florida real estate transfer tax varies depending on the county. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

Further for all other types of transfers in Miami-Dade County there is an additional tax of 45 per 1000 that. Typically the real estate agent obtains a check for the amount from the seller. Transfer taxes can be levied by a city county state or a combination.

Call The Law Office Of Richard S. PDF 125 KB. Regardless of where the deed or other document is signed and delivered documentary stamp tax is due.

This fee is charged by the recording offices in most counties. There is no specific exemption for documents that transfer Florida real property for estate planning purposes. A real estate transfer tax sometimes called a deed transfer tax is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of.

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Real Estate Education Real Estate Buyers

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How To Save For Your First Home Buying Your First Home Sarasota Real Estate Real Estate Infographic

Transfer Tax And Documentary Stamp Tax Florida

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Texas Real Estate Transfer Taxes An In Depth Guide

A Breakdown Of Transfer Tax In Real Estate Upnest

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Transfer Tax And Documentary Stamp Tax Florida

What Are Real Estate Transfer Taxes Forbes Advisor

97 Real Estate Infographics How To Make Your Own Go Viral Real Estate Infographic Real Estate Trends Home Buying Tips

Free Florida Residential Purchase And Sale Agreement Word Pdf Eforms Free Fillable Form Purchase Agreement Residential Real Estate Real Estate Contract

Hidden Costs Of Buying A Home Home Buying Buying Your First Home Buying First Home